ERP finance modules guide (finance features in ERP)

Your ERP finance module is a significant component of your ERP implementation - it handles everything from accounting procedures to tracking profit, and financial reporting. While it's expected that your ERP financial module should handle features such as accounts payable (AP), and your general ledger (GL) requirements, there are a vast range of functionalities available in today's ERP software market. ERP systems have a wide range of capabilities in all areas, and finance is not unique in that different systems will support different requirements.

When you’re validating ERP financial modules for your own enterprise purposes, you should be prepared to investigate and clearly understand these capabilities, to meet your specific functional requirements.

Enterprise resource planning systems typically operate on a modular format with the ability to take or remove components from your configuration - it is unlikely you will opt to remove financial features from your main system, but there are other components you may add which you should ensure are supported by your system.

If you are handling payroll and reporting in your ERP, you should make sure that your ERP can consider this in its calculations - particularly when tracking profit and loss in time to manufacture items beyond simply tracking material cost.

Understanding the ERP finance module

To clarify, the ERP finance module acts as the backbone of an organization’s financial processes within the system. While it's commonly referred to as the finance module in ERP or the ERP accounting module, its core function is to centralize, automate, and streamline a business’s financial data, ensuring accurate and timely information is always accessible. The finance ERP module spans all financial aspects, including core accounting processes, budgeting, forecasting, and financial reporting, each of which supports strategic planning.

What is an ERP finance module?

An ERP finance module gathers financial data and turns it into reports, including quarterly financial statements, ledgers, profit tracking, and balance sheets. A finance module in ERP is a central part of your business - you need to know where the money is.

While standalone accounting systems focus solely on bookkeeping tasks, the ERP accounting module is embedded within the ERP system, integrating with sales, procurement, and operations. This interconnectedness helps track financial data across the entire organization, improving both financial transparency and strategic alignment.

Your finance module should handle transactions and invoices, as well as offer reporting and revenue management across your entire business, spanning all your departments, and allowing each department access to the data they need.

The key role of financial management in ERP systems

Integrating financial management in your ERP allows you to go beyond simple accounting tasks, adding features that actively aid in strategic decision-making. Here are some primary roles of financial management in ERP:

- Enhanced budgeting and forecasting: By tracking historical data and spending patterns, finance ERP systems enable businesses to set realistic budgets and accurately forecast future expenses.

- Data-driven decision-making: With centralized, real-time financial data available across departments, stakeholders can make faster, more informed decisions.

- Regulatory compliance and reporting: The right ERP will ensure that all financial records are compliant with local and international standards, aiding in smoother audits and accurate tax reporting.

- Cost efficiency and expense management: By optimizing cash flow, tracking expenses, and identifying cost-cutting areas, ERP financial modules support a healthier financial ecosystem.

What ERP finance module features do I need?

- General Ledger

- Accounts Payable

- Accounts Receivable

- Asset Management

- Cash Management

- Customer management

- Vendor management

- Banking management

- Profit tracking

- Multi-currency capabilities

- Reporting

This list is not exhaustive but includes lots of areas where financial reporting and tracking are important to most businesses. Your ERP financial module is a distinguishing feature of ERP - most integrated systems don't allow for full oversight of spend and financial reporting across all areas of business like ERP does - make sure you use it effectively.

Cash management, for example, tracks daily cash flow, allowing finance teams to better plan investments and ensure liquidity. Meanwhile, asset management provides insights into both tangible and intangible asset values, optimizing their use and scheduling for maintenance to avoid unexpected expenses.

ERP finance module features

Let’s take a look at what a typical full-featured ERP finance module offers then work against this set of capabilities until your own requirements exceed, meet, or fail to meet the baseline. Using Oracle’s ERP finance module as a model, the following functional tiers apply:

Guide: 70 features to look for in your next ERP

- General Ledger (GL)

- Accounts Payable (AP)

- Accounts Receivable (AR)

- Asset Management (FA)

- Cash Management (CM)

Within these tiers, necessary data dependencies apply involving:

- Customer management dependency due to the AR tier

- Vendor management dependency due to the AP tier

- Bank management dependency due to the CM tier

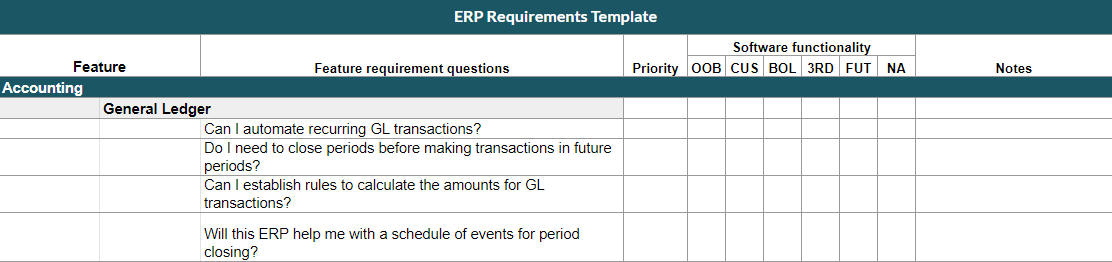

When considering your financial ERP module requirements, you should break down your business' needs from each feature. For your General Ledger requirements, you may request automating transactions, or you'd like your ERP to have preset rules that calculate the amounts for your GL transactions.

In Accounts Payable, you may need your software to be able to accept invoices in multiple currencies, as well as different payment systems. Your ERP finance module requirements are something you need to strongly consider when drafting up your ERP requirements document, our requirements template includes eight sections, and twenty functionality questions so your business has a full picture of exactly how your ERP needs to handle finance.

At an enterprise-wide finance level; other necessary data integrations apply including:

- Accounting management integrated in association with the GL tier

- Soft and hard assets management in association with the FA tier

Each dependent tier, and/or related enterprise integration interacts with three core elements:

- A form generator that allows the entry, alteration, or deletion of individual records

- One or more distributed databases that store, and retrieve individual or multiple records

- A report generator that retrieves and soft-displays, or hard-prints, consequent, demand-based information

Processes managed by ERP finance modules

Ultimately these direct and indirect components allow a series of cohesive financial actions that allow the user to execute the following processes:

- Manage interactions between the enterprise and any involved product vendor, supplier and service provider by using the AP tier.

- Receive, account for, and manage customer-driven revenue data via the enterprise GL integration and the AR tier.

- Manage and reconcile bank-related records through the auspices of the CM tier.

- Index, track, value, and actively manage soft, and hard, assets across the enterprise by use of the FA tier in association with the GL integration.

- Establish, track, value, and manage the enterprise’s overarching financial framework by applying the GL integration.

Together, these five key features establish an ability to produce a comprehensive, finance-based understanding of the enterprises’ business situation in real-time. When applied appropriately, these feature sets produce relevant financial information that will accrue to not only the company’s business goals but also its operational requirements as well.

Choosing the best ERP system for Financial Services

For industries like banking, insurance, and investment, selecting the best ERP for financial services is crucial due to their unique requirements, such as multi-currency transactions, risk assessment, and stringent regulatory compliance.

Consider the following features when choosing an ERP system for financial services:

- Advanced security features: Financial institutions require ERP systems with high-level security protocols to safeguard sensitive financial data.

- Real-time financial reporting: Timely reports help meet regulatory requirements and provide insights into financial health.

- Scalability: The ERP should grow with the institution, accommodating increasing transaction volumes and additional compliance requirements.

- Integration capabilities: Seamless integration with other financial tools, such as risk management and auditing software, ensures operational efficiency.

Popular ERP solutions tailored to financial services include Oracle ERP, SAP S/4HANA, and Microsoft Dynamics 365 Finance, each offering industry-specific capabilities.

Final thoughts

As I mentioned at the outset, while this baseline description represents a full-featured model, smaller ERP platforms may, or may not, apply. Consequently, as with any other feature validation effort, be sure that you begin your process by establishing a comprehensive set of requirements to use as a planning tool.

Should you fail to do so, you will run the risk of missing some salient bit of information or, worse, buying the wrong system, for the wrong reason, at the wrong price.

Free white paper

ERP Requirements template

Plan your ERP selection using our requirements template with 100 features in an editable spreadsheet. Include special requirements and extra detail in this exclusive template.

Featured white papers

-

Calculating ERP ROI: 5 steps to success

Calculate your new ERP's financial benefits with this comprehensive guide

Download -

ERP Software RFP Guide & Template

The comprehensive guide to developing an RFP document for your ERP project

Download -

70 features to look for in your next ERP

A comprehensive guide to help you identify requirements for your ERP selection

Download

Related articles

-

ERP vs. HRMS: which should manage your payroll?

Compare the advantages and disadvantages of using HRMS or ERP to manage your payroll

-

CMMC Compliance: What Aerospace and Defense Manufacturers Need to Know

Key insights on CMMC compliance, deadlines, and securing DoD contracts with CMMC 2.0 certificatio...

-

A complete introduction to using ERP for fleet management

Your ERP can be a brilliant fleet management tool if you use it correctly. Learn how with this in...